|

I have closed the XLU trade at $.18 debit. This was a very low maintenance, high probability trade. XLU has a very high Variance Risk Premium, so these kinds of trades are perfect for this vehicle.

0 Comments

With $SMH, I am officially making a slight expansive adjustment. I am going to be buying back half of the bullish verticals for $112.50. It is a profit on those legs, but allows for more downside. This was part of the newsletter plan.

After being exercised in some of my $RSX September Puts, I decided to do a little bit of a different trade. Buy back your 21Sep puts in RSX, then sell 100 19Oct $20 strike, and buy 50 19Oct $18 strike puts.

If you put this one on, you may need some help to prevent any kind of margin errors. Please direct message me on Twitter. This is due to a thesis change. $GS trade, meant to capture a large 3rd wave up in November, is showing the chances of weakening. Sell half of the position at $.56 credit for a 19% gain. This is strictly a technical play; reload when $GS reaches $229.

Newsletter alert: Sold $GD fly at $4.27. This was bought at 3.75, a 13.9% gain.

With such high gamma (since we are close to expiration), I will sell it sometime today (August 14, 2018) instead of rolling the dice between a massive gain or massive loss tomorrow. Could have made more after earnings, but I won't complain about a profit. Thanks, Zac Mannes! As my vacation wound down, I was greeted with a couple of concerning news items.

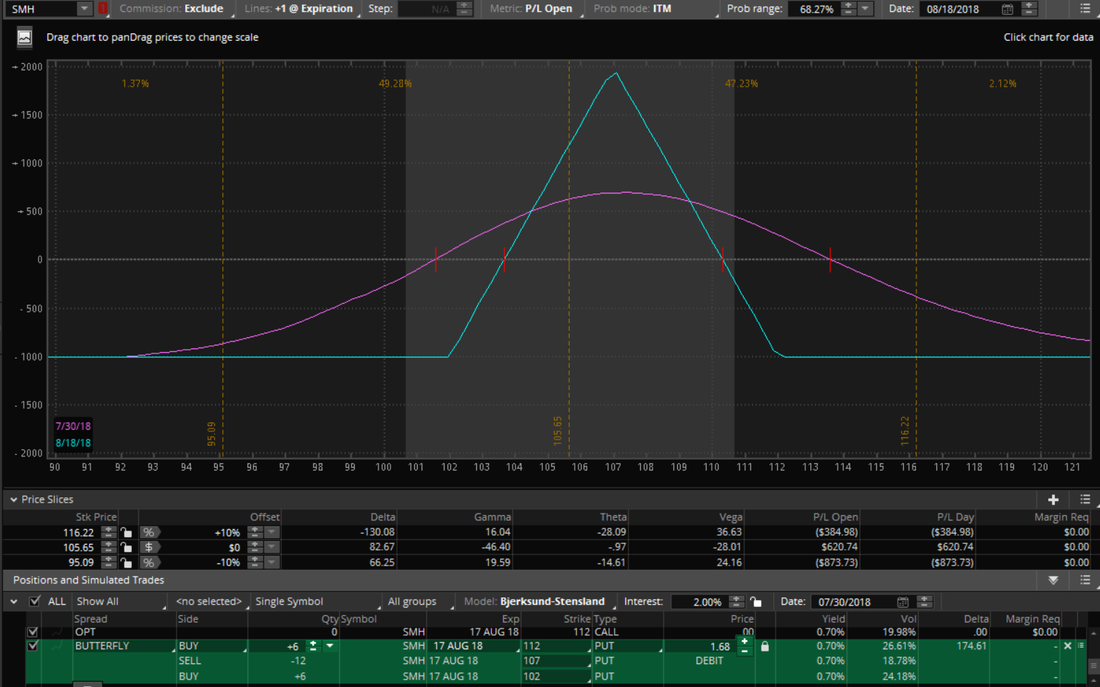

One of the tariffs levied upon the US was on semiconductors, which had a direct effect on our SMH trade. As a reminder, the SMH trade was a 102/107/112 put butterfly expiring this week. Thursday close was at 108.14, so there was some room to drop. However, the news caused a gap down to 106.44, causing the IV to spike, liquidity to drop, and our returns to start feeling some heat. I always tell option traders to wait for the market makers to catch up to any gaps before trading, usually at around 10-10:30am unless it is an emergency. Because we weren't very far from our short strike, I didn't consider it an emergency. In fact, the trade was a little green on the day. However, because of the news I was expecting volatility to pick up a little bit, which hurts a vega negative position such as a butterfly. Since the news was negative and SMH price was below the short strike (we were delta positive after the gap), I felt the return had a greater chance of shrinking than growing. Finally, since expiration is 1 week away, gamma is relatively a high negative number which would eat into profits further if more downside were to be seen. You can see this in the chart below. The purple is the P&L now, the blue is the P&L at expiration. If we saw a continuation down on Monday, you can see how much profit it would take with it on our position, and how little we had to gain if it spiked up. The position would depend on a bounce, which I wasn't confident in, especially considering EcoQuant's chart signaled more downside. So even though we did not meet our expected profit of $750, we were within $1.50 of our short strikes, and EcoQuant identified the chance of a small pop before further downside, I decided to close the trade. This is how you trade by the greeks with a technical thesis. Fundamental newsletter subscribers: cover your $CELG shares with 17Aug $100 calls @$.50 credit.

I don't expect CELG to reach that high, but this just adds some profit to the position, using the elevated IV of earnings season. Because I will not be able to track my trades a lot over the next week, I officially closed my $RUT trade at $28.33 debit. I put it on at $31.50 credit, which yields $3.17 profit for 17.1% return.

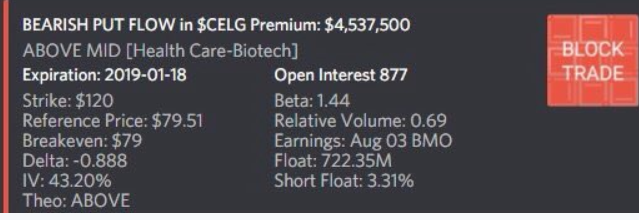

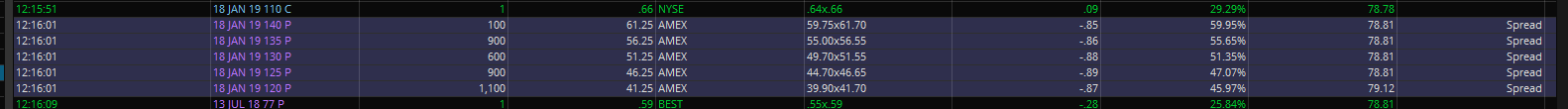

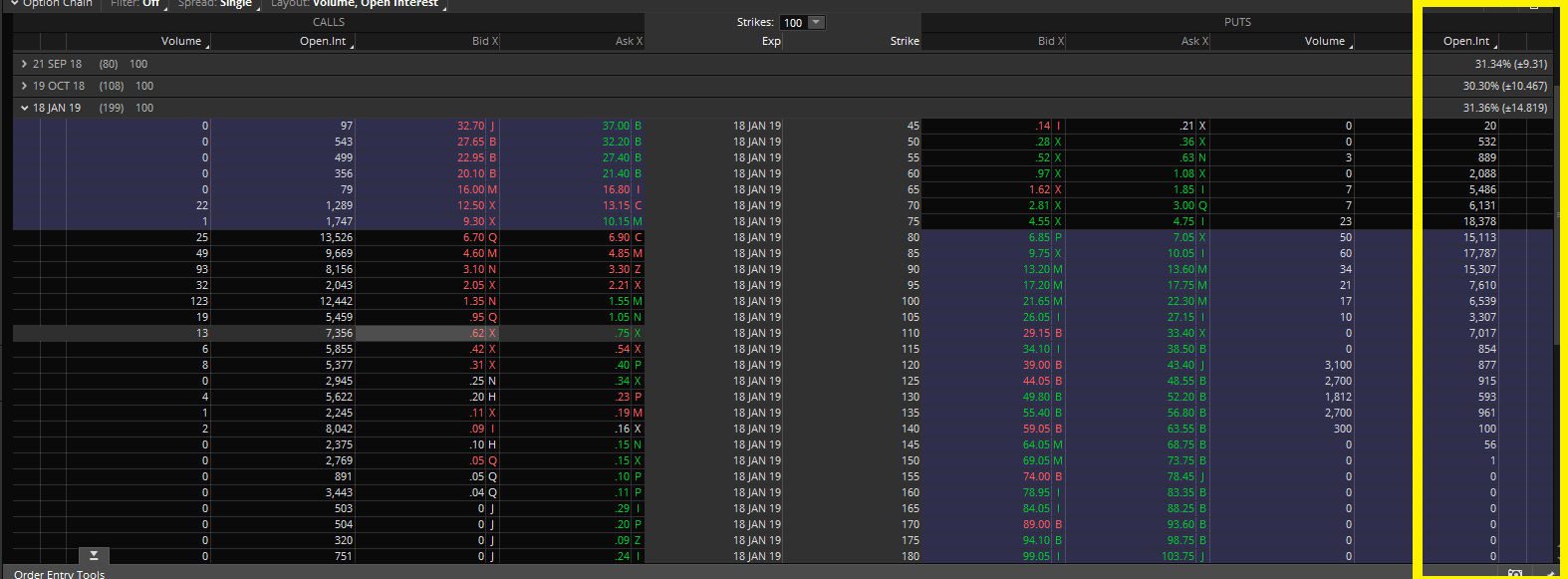

This has more time and room to run, so if you keep it on, I wouldn't blame you. It is theta positive, and there is still upside according to EcoQuant's chart in both time and price. If you decide to keep this on and need my input, I may not be able to return your message immediately. So if you do not have a feel for the trade, I suggest taking it off now as well. Being long Celgene, I noticed an alert that as an option trader gave me pause: It struck me as strange. If this was truly bearish, anyone with that kind of money would trust an option trader to buy out-of-the-money to take advantage of convex gamma. This trade was not only in-the-money, it was deep in the money. It is almost -89 delta! So I decided to look at time and sales and found that this is not the only transaction like this. There were plenty. Some were even labelled “spreads”. A few things jumped out. The first is that even though the price was closer to the “ask” than the “bid”, when you add the “underlying” and the cost of the option, it adds to near the strike. So these could have been bought or sold at very small premium. So I checked the open interest to see how prevalent this has been. The answer is, very prevalent. That is an unusual amount of open interest for a selection of put strikes that are in the money.

Who could be involved in those transactions? Since I’m long CELG, I remembered that on May 24th, Celgene announced an accelerated $2B buyback program through Citi Bank that will expire on August 31st. I looked at Celgene’s cash flow statement, and as of the end of last year, they had $843M in positive cash flow. Not bad, but where are they getting $2B? Even if they got more cash flow despite a stock that has been struggling for the past year, that would put them in a difficult spot from a cash standpoint. Moody’s even claimed that this repurchase program is a negative for Celgene’s credit. By now you might have put together my theory: Celgene or Citi are selling these puts to finance the accelerated buyback. If this is true, it is brilliant. They sell these puts and collect millions of dollars. The transactions today alone resulted in ~$50.5M of premium collected if this thesis is true. If you took half of the open interest (assuming all the contracts were bought and sold to open), you are looking at ~$500M collected already, or 25% of the total accelerated buyback. Once collected (which might take a little while), I presume that Celgene and Citi would do a measured purchase of the stock. With this power behind it, you can assume Celgene stock will go up, which will lower the value of those puts. When the buyback is completed, Celgene and Citi will buy back those puts at a lower cost. The result? Celgene has their repurchased shares with the money provided to them by the buyers of those puts, likely automated market makers. I do not know if this is legal. It likely is, as the buyers of those puts are responsible for doing their due diligence. It isn’t like Celgene didn’t announce the buyback. If it is legal, it is a clever arbitrage. We may see one more dip, but it is time:

Add 5 more spreads to SPX Dec. Long gamma trade. Buy 5 2950, Sell 5 2975 at $3.60 debit. |

The WizardJason DeLorenzo Archives

September 2023

Categories |

|

RSS Feed

RSS Feed