|

As my vacation wound down, I was greeted with a couple of concerning news items.

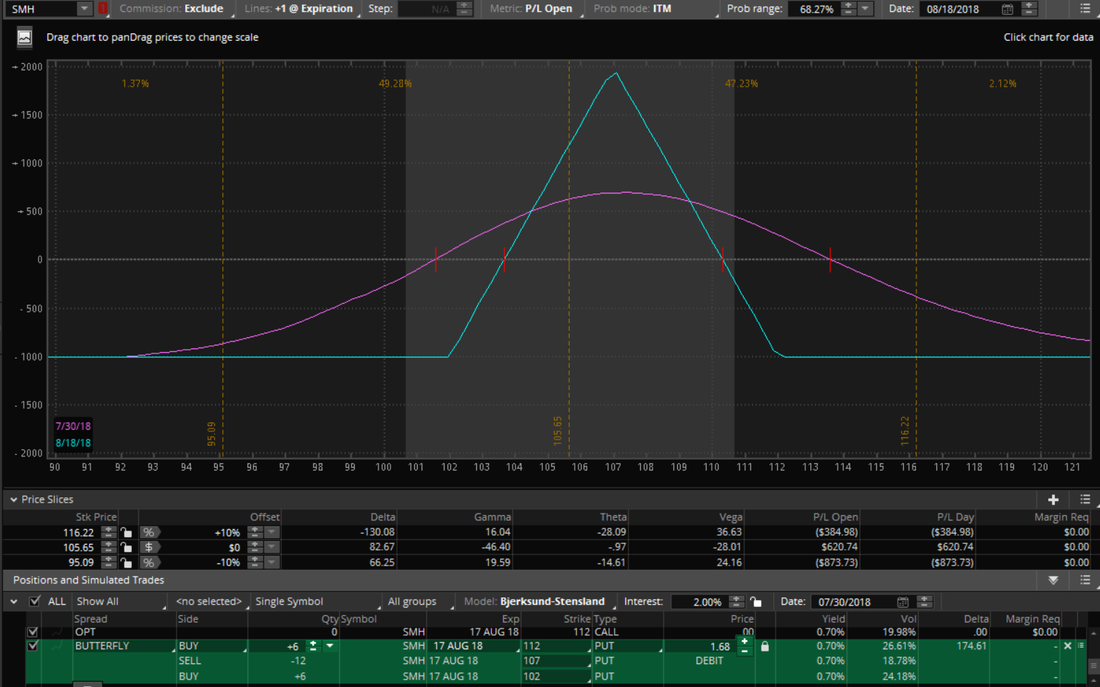

One of the tariffs levied upon the US was on semiconductors, which had a direct effect on our SMH trade. As a reminder, the SMH trade was a 102/107/112 put butterfly expiring this week. Thursday close was at 108.14, so there was some room to drop. However, the news caused a gap down to 106.44, causing the IV to spike, liquidity to drop, and our returns to start feeling some heat. I always tell option traders to wait for the market makers to catch up to any gaps before trading, usually at around 10-10:30am unless it is an emergency. Because we weren't very far from our short strike, I didn't consider it an emergency. In fact, the trade was a little green on the day. However, because of the news I was expecting volatility to pick up a little bit, which hurts a vega negative position such as a butterfly. Since the news was negative and SMH price was below the short strike (we were delta positive after the gap), I felt the return had a greater chance of shrinking than growing. Finally, since expiration is 1 week away, gamma is relatively a high negative number which would eat into profits further if more downside were to be seen. You can see this in the chart below. The purple is the P&L now, the blue is the P&L at expiration. If we saw a continuation down on Monday, you can see how much profit it would take with it on our position, and how little we had to gain if it spiked up. The position would depend on a bounce, which I wasn't confident in, especially considering EcoQuant's chart signaled more downside. So even though we did not meet our expected profit of $750, we were within $1.50 of our short strikes, and EcoQuant identified the chance of a small pop before further downside, I decided to close the trade. This is how you trade by the greeks with a technical thesis.

1 Comment

|

The WizardJason DeLorenzo Archives

September 2023

Categories |

|

RSS Feed

RSS Feed