|

All corners of #FinTwit have their own personalities, and they need to be evaluated in the light of their industry. Here is my impression of these groups, and how I like to assess what they are saying. Hopefully my red flags are helpful. If you want me to look at an analyst, please share in the comments. I always like finding some new sources of data. Macroeconomists

I have yet to find a macroeconomist that has ever posted that "everything is fine". There is always a problem, and the problem will manifest in minutes instead of years. There may be validity to their claim, but study it for yourself, and figure out what metrics must be studied to forecast the problem is coming true. Also, find and read the opposing viewpoints. I put Fed watchers in this category, but they tend to be less doom and gloom. Zerohedge is in here too. Equity Traders If they are not bots, they typically have a method that has massive blind spots. Technical analysts do not consider fundamental analysis; value traders treat growth like they will eventually get cleaned out; while growth sees value as antiquated. Short sellers troll everything. In some pockets they battle over equities themselves (like a biotech company with a binary event approaching), but more often than not the different strategies are what are being fought over. In this group, I will look at some theses, but validate them myself. Bonds/Rates Traders Because the bond market is more complex and opaquer than all other markets, bond traders troll more than any other. There are camps on either side, and the insults are frequent. The adage is that the bond market is the “smart money”… but it is more like the ego market. Because nobody has a complete grasp of bonds, many assert superiority by attacking the other camp. I just read both sides, and try to assess for myself. One funny thing is when one says another is a charlatan, or a liar, I follow them to get their point of view, too. 😉 Options/Volatility Traders Options traders get very deep in the weeds. This corner of #FinTwit is very mathy/quant, and in many cases is TMI. A lot of that is not as applicable to the typical trader, but it is interesting the more you dig. There is also a weird dynamic in options trading circles that feel like everyone is on the same team. They are the most helpful, possibly because options theses typically are more related to multiple variables. Further, knowledgeable options traders know we aren’t competing against each other; we are trying to find edge within an ecosystem. I’m not afraid to ask questions of options traders. They typically answer well, and it mostly about internal system workings. There is some trolling, but I think that comes naturally in Twitter. Energy Traders Energy trading is closer to a science than any other sector. There is very little new news in the #OOTT crowd. They know how much is being produced, what the consumption seasonality is, futures price flows, etc. Because these traders are knee-deep in it, their opinions are very well-informed. However, this also means there is very little edge. I listen to them, but typically there is almost always consensus. Metals Traders I have not met one metals trader that said gold is going down. The assumption is metals are always going up, and their only job is to determine how deep any dip will be. To be honest, I have found maybe one that I will listen to even a little bit.

0 Comments

This article, "The Social-Media Stars Who Move Markets", inspired this post and my Twitter poll responses validated my inspiration. Then there is the trend of red flag posts. It is like the universe wants me to write this. Offering #FinTwit content? Consider this an examination of conscience. # 1. “Look at this fancy car, purse, house, jewelry!!!!” Their non-investment posts are excessively materialistic. The goal is to make you believe they can afford these luxuries bc their trades are so good. Not only are they making money on their viewership (NOT trades), but if that is an attractive feature to you... please examine why you are trading. Successful traders treat their portfolios like a business. Withdrawals are only made if absolutely necessary. The trade of future earnings for a Ferrari is a terrible trade #2. “This trading strategy works EVERY TIME!” This statement ignores changing market environments. Even if there was a magic bullet, it would be front-run. Typically, when this is advertised, they're trying to teach YOU this strategy. It seems great that now you can do this strategy yourself, but shifts responsibility for failing onto you. Now when you lose money, it is your fault that you didn’t follow the strategy correctly. #3. “Diamond hands!! ” “HODL!!” “YOLO BETS!” This person trades by emotion. They will scream at the computer when they are failing, and talk hyperbolic trash when they succeed (e.g. they compare themselves favorably to Warren Buffett). This is a psychological trick (In-Group Favoritism Bias). They align their emotions to yours & you develop a favorable opinion of them. “Diamond Hands”, “HODL”, etc. are subtle ways this manifests; these terms make you feel part of a “retail team”, but you're being taken advantage of. #4. The #FinTwit troll They will mock others with the intent to invalidate their point of view. This is to distract you from the fact that their OWN point of view is fallacious or incomplete. #5. “This just happened and it’s obviously because of THIS reason.” This is retroactive attribution. They will say something that makes sense in retrospect, but has no predictive power going forward. Further, it is short-sighted & is not data-based. Popular financial media universally falls in this category. When you read why the market moved on popular financial media, not only is there a low chance of it being correct, but also a low chance their logic will carry forward. #6. #FinTwit Clichés/adages in problematic context “Sell in May and go away.” “The market can stay irrational longer than you can stay solvent.” “Bulls make money, bears make money, pigs get slaughtered”. These common adages are fun, and - when taken in context - they have an element in truth in them. But that’s the problem; it is that element of truth that leads you into a false thesis. Take, for instance, the adage that gold is an inflation hedge. Look at gold’s correlation to inflation, M2 money supply, or value of the dollar. None of it works. We should demand data or clear logic to back “given” assertions. They must answer the why, at least somewhat satisfactorily. #7. Using past performance to validate an opinion Many successful investors have had a successful year or call that has been publicized; that call becomes the reason all their calls will succeed going forward. Cathy Woods. Michael Burry. They're people, too. Their theses need validation as much as anyone’s. This isn’t to say they have no insight, but validate their theses yourself. Ask why. I mention Woods & Burry because now they're being “Burry-ed”. Had to do it. #8. #FinTwit’s Constant Apocalyptic Proclamations

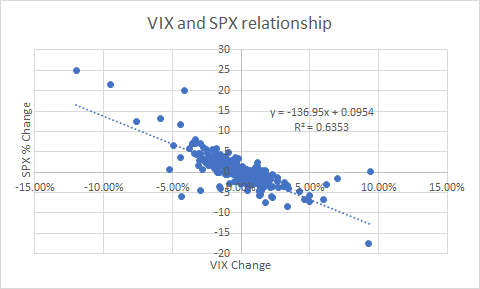

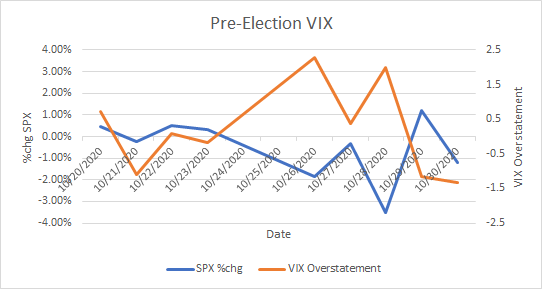

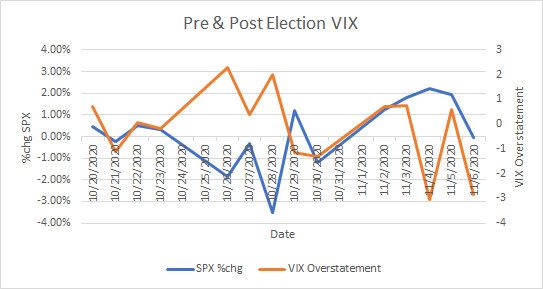

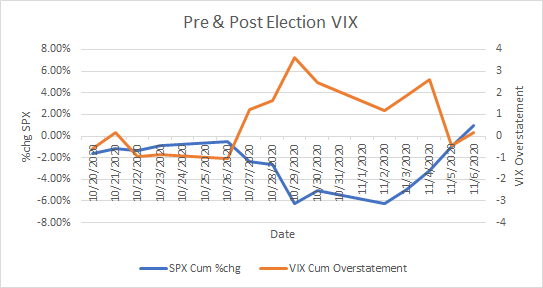

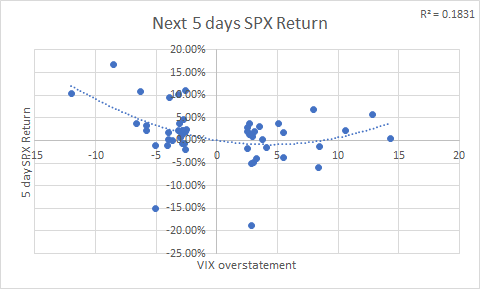

There may be issues with the economy, or the financial system, etc., but a couple things need to be understood when hearing these calls. First, they're designed to stoke fear in you, not wise investment decisions. Second, it is in no one’s best interest for the financial system to collapse. Even a government that most don’t trust will do whatever they can to stop that from happening, even if actions just delay the inevitable. “The Big Short”, “The Smartest Guys in the Room”, and other movies are anomalies, and even somewhat glorify positioning a portfolio for economic collapse. Be careful not to fall into that trap. #9. #FinTwit Technical analysts that claim to be both the why & what of the market This isn't against technical analysis (TA) itself, which I think has a place in analysis. When analysts say the market is moving BECAUSE of a technical reason, that’s a sign that they have no context. Even if correct, a rally didn’t happen because a trendline broke, a bullish engulfing candle was confirmed, we reached a fib, etc. These are signs of something else. They fail as much as succeed and need context to be an effective trading strategy. #10. Ego-Driven #FinTwit They repeatedly show successes and never a failure. They are unwilling to see an alternate point of view presented in comments. Even obvious errors are not taken responsibility for (like a misspelling). That means their theses aren't receptive to alternate points of view, and they cannot be considered comprehensive. These #FinTwit people may be smart, but they are also very obnoxious. Stay tuned for part two! Let me know your thoughts in the comments. This is a post about one of the market correlations that has been consistent over the past decade+, although I will be focusing on 2018-current. The SPX/VIX relationship everyone *knows* exists, but only assumes the correlation and its meaning. $VIX is many things, but at its core it is a measure of implied volatility (IV) on $SPX. This represents the supply and demand in $SPX options. The demand comes from customers while the supply primarily comes from centralized market makers (MMs). Because the MMs have more uniform goals (to isolate and collect premium on their options), the supply side is much easier to analyze. When you look at the SPX/VIX graph, you can’t help but notice how correlated it is. Essentially, MMs have a liquidity comfort level on their offerings given a daily $SPX level. This would be the historically standard premium they are charging you for options on a daily basis. Considering what we know about delta hedging, there is a clear causation as well. If $VIX goes up more than the change in $SPX would indicate, that is a sign that MMs are less willing to sell puts at these levels (VIX overstatement) and vice versa. This is usually in the case of an upcoming event. Once that event passes, IV invariably comes back down. When IV declines, that unwinds hedges and we see massive rallies. Lets take the Biden/Trump election in Nov. 2020 as an example. Here is a chart where orange is the $VIX overstatement and blue is the $SPX return pre-election. Demand was clearly rising for puts pre-election. A lot of that selling was due to MMs hedging those puts. If VIX overstates, market participants are hedging. If the market does not drop below the aggregate premiums on the option chain, be ready for mean reversion. This is from charm and vanna: decay in IV that decreases the value of customer hedges and decreases the amount of hedging needed by MMs. When MMs decrease their hedges, they cover their shorts. What happened after the election didn’t result in the world exploding? Not only did the VIX overstatement mean revert, but SPX did as well. The election wasn’t even settled until much later, and the market already made the decision that the world was not going to explode no matter who won. Here's the cumulative chart during that time: Do you need a quantitative measure of the deviation? On a daily basis, these are the returns of VIX overstatement when it is >-2.5 or <2.5. Those two “outliers” that need to be taken seriously are 3/5/2020 and 3/13/2020. There is a strong indication that when VIX overreacts (+ numbers) downside abates and a mean reversion will happen. The VIX underreactions tend to be soon after the overreactions. This is a a solid indicator but needs to be taken in context of the market at the time.

I don't have data to prove it yet, but this indicator scales. If you see a strong overreaction in a short amount of time, you are likely to see a small bounce. Cumulatively it works too, but I think it scales on a function of a log scale, so I have work to do on that front. In the end, the action is to monitor the deviations VIX has from its SPX correlation. Develop a thesis around the situation it is tracking and act accordingly. It is very likely that we will see mean reversion in both VIX and SPX. This content originally appeared on the Wizard of Ops Twitter here: https://twitter.com/WizOfOps/status/1446117113735749638 |

The WizardJason DeLorenzo Archives

September 2023

Categories |

|

RSS Feed

RSS Feed