|

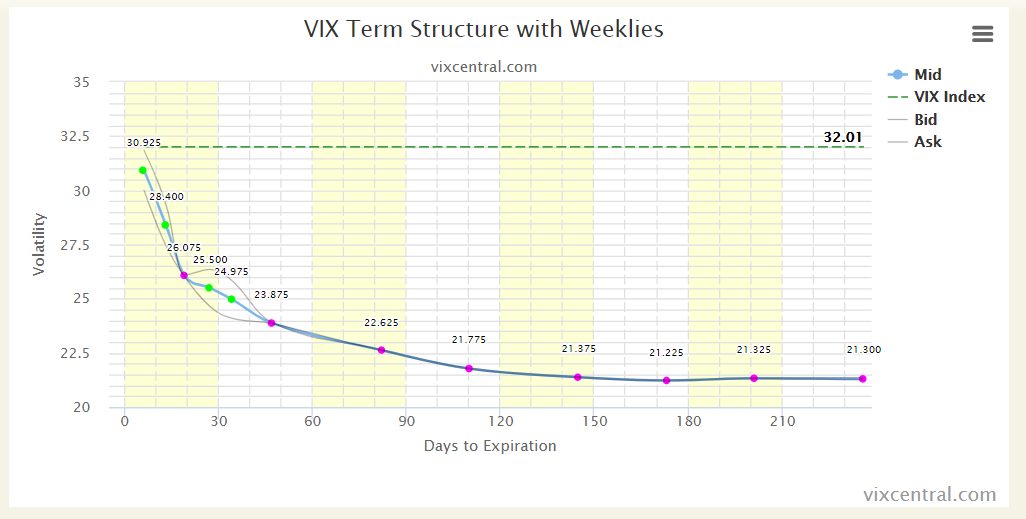

A term structure is the mapping of the underlying’s volatility at different expiration dates. The volatility of an expiration date is determined using a weighted average of multiple strikes on the same expiration date. When you compare all of those implied volatilities for each of those expiration dates and graph them, they make a chart. Here is an example: Note, the implied volatilities you see here are for the term of the option class. So if you are looking at weekly term, the implied volatility number shows the implied volatility between the expiry you are looking at and the one that expired in that term before it. So for instance, if you are looking at weeklies (like you see here), the number at the second green dot is showing the implied volatility between the first and second dot, not the second dot and today. Keep that in mind. So how does this help with your strategies? Typically, the term structure looks like the exact opposite of what you see above, a swiftly rising curve that flattens at the top. This is called contango, and expresses the increased uncertainty further out in time. When the curve looks like it does now, it is called backwardation. This happens when the short term is highly volatile and option traders expect the market to return to normalcy in the future. When the market is in backwardation, as it is now, I love to put on calendars. This is because the near-term options are overpriced relative to the options in the outer terms. That makes the trade extremely forgiving if wrong on direction, and allows for multiple sales of options against the same long option. So if I have a hint on direction, I will put on a calendar (especially if bearish), and if I don’t I would consider a double calendar at the long strike’s implied movement strike. These kinds of trades have excellent return to risk. The capital required may be a little higher, but the probability of success is extremely high. The SPX double calendar I have on right now taking advantage of this term structure has an 80% chance of 30% gains over the next 2 weeks.

0 Comments

There seems to be a lot of chatter and momentum in the options space about binary options. A binary option is different in that it has two outcomes, max gain or max loss… hence the name, "binary option". So unlike a regular option, these options do not have infinite gains nor variable gains based on how much higher the underlying is above the strike price at expiration. The gain can either be an asset or cash, and these options are bought or sold for a premium.

Basically, these options are like a sports bet. Let’s say you put $10 down on a 50/50 chance for a team to win. If you are right, you get paid back $9, if you lose, you lose $10. Because of this, it is foolish to buy binary options if you are paying a premium since the payout is a 50/50 chance. In fact, in many countries, binary options are considered a form of gambling and are illegal. Many binary option brokerages have turned out to be scams, so when it comes to binary option trading, do not even bother. However, one thing that binary options do offer is a great way to evaluate pricing models and option pricing. From an option pricing point of view, a binary option kind of acts like a vertical at the same strike, making for much easier calculation of return to risk. It also is shown to be a great tool to measure the efficiency of the return of a vertical, since the middle ground of a vertical is the non-binary part of the calculation and tends to get in the way of the OCD option trader’s return to risk calculation. Therefore, a 1 wide vertical in most underlying vehicles can synthetically represent a binary vertical. I highly recommend that, since the return-to-risk is higher in that strategy than any other vertical spread as shown by binary options. In short, binary options are the academic option student’s delight, but from a practical standpoint, they are a scam. |

The WizardJason DeLorenzo Archives

September 2023

Categories |

|

RSS Feed

RSS Feed