|

Who are Dealers? When an option order is received, a middle man, called an “options dealer”, “options market maker”, or “options wholesaler”, is financially incentivized to accept the order. These entities (individuals, firms, etc.) provide essential liquidity for markets to function. Because they are exposed to adverse selection, they are motivated to hedge their risk. In fact, at the end of every day, this form used to be filled out by the risk manager for each market maker. If any of the categories fell outside an acceptable threshold, the dealer is warned the first time, and fired after their second violation. If fired for this reason, they would not be hired by another dealer firm. Nowadays there are only a few wholesaling companies led by Citadel who handles a large portion of option orders. Currently, most market making is done through algorithms and computers, and there is very little physical trading at an exchange. It is estimated by the Chicago Board of Options Exchange that 85-90% of all option orders are accepted by option dealers. How do Dealers Operate? Dealers have 4 main ways to alleviate their risk. Their first and most preferred choice is to find a willing customer on the other side of the trade to hand off the contract to. This creates guaranteed income with no risk for the dealer. The second choice is to hedge with other options that reduce the overall greeks in the book. The third choice is to hedge with the underlying stock through delta hedging. The fourth choice is to hedge with associated or correlated products, for instance hedging SPX options with a basket of stocks meant to mimic the index, or hedging SPX implied volatility with /VX futures or swaps. What Portion of Market Moves is Option Liquidity? As shown in numerous academic papers, option liquidity and gamma hedging account for roughly one third of underlying trades in equities! It is estimated to be the largest source of equity flow in the market today at any given time. It can be approximated through option notional value traded against equity notional value traded. How Does Volland Measure Option Dealer Positioning?

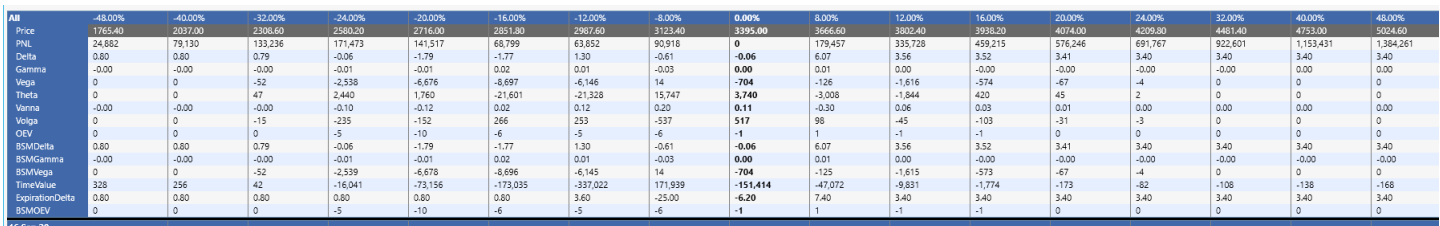

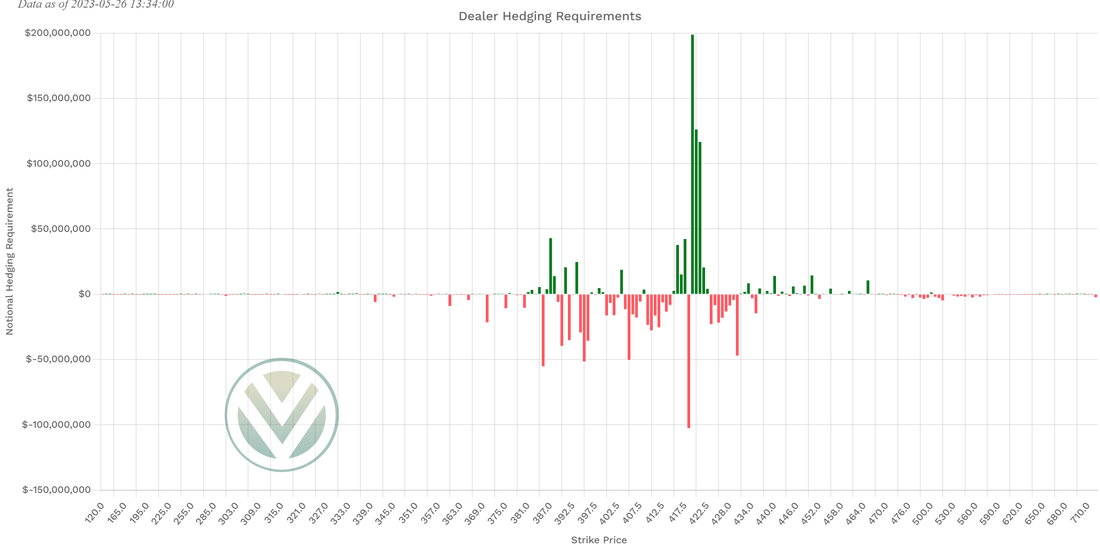

Volland uses a real-time option trade execution feed through the Option Pricing Regulatory Authority (OPRA) to identify every option trade executed. On an option order-by-order basis using executed price, surrounding orders, Black-Scholes fair value, and Bid/Ask spreads as a guide, Volland determines if each order filled is a buy or a write on the dealer side. For each transaction, Volland calculates the greeks that represent the risk the dealer is assuming. For each strike at each expiration, Volland compiles the total dealer positioning. For the Exposure Sheet, Volland calculates how much of each greek exposure the dealers would have at each strike. This is relevant to determine the hedging momentum for each greek. The charts on the relative value page show the relative exposure compared to the prior 12 months. This helps to indicate if a regime change is arriving and helps contextualize the current environment.

0 Comments

Leave a Reply. |

The WizardJason DeLorenzo Archives

September 2023

Categories |

|

RSS Feed

RSS Feed