|

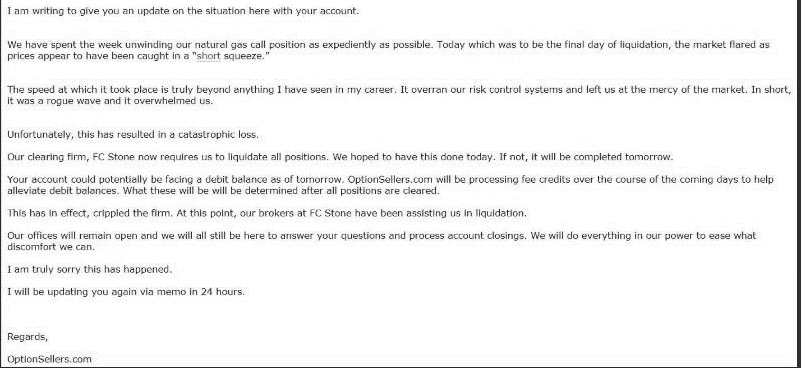

If you have watched my webinar series, I warned against going naked calls. Most of the time, brokers do not let you sell calls naked. This weekend, a group called OptionSellers.com went bankrupt for selling calls naked on UNG, or natural gas. Here is their letter to investors: It doesn’t matter why natural gas shot up 10% in 3 days; it happened, and OptionSellers.com should have had a risk management plan.

Being that a major portion of my personal strategy is premium selling, here are some things I am doing differently that would prevent such a catastrophe: 1. NEVER go naked short calls. I would always make short positions into verticals. 2. Delta hedge. You may not make as much money, but it is a major tool in taking drastic moves out of the equation in these positions. 3. Given the above, I will always pay attention to the return to risk. This can be done primarily using the Sharpe Ratio, measuring discounted investment returns over the standard deviation of the probability of its success. But it doesn’t work when the risk is “infinite”. 4. I will manage your portfolio risk responsibly as laid out in our ADV 2A, including not using margin. I guarantee that you would NEVER be found in a debit. Risk management is paramount to my trading strategy, as it should be yours. I cannot guarantee I won’t lose money, but you will not be left in financial ruin like this hedge fund has left their clients.

0 Comments

Leave a Reply. |

The WizardJason DeLorenzo Archives

September 2023

Categories |

|

RSS Feed

RSS Feed