|

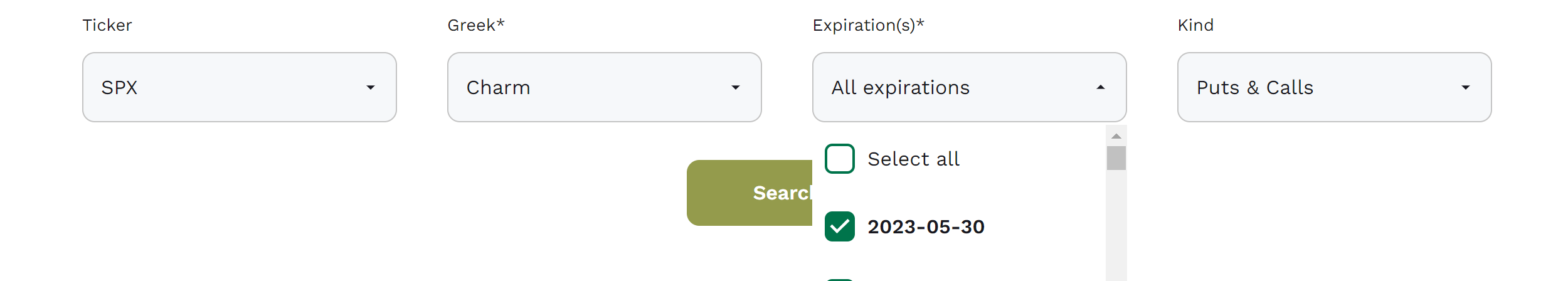

0DTE stands for zero days until expiration. These are options that expire that same day. (Likewise, 1DTE, 2DTE, etc. stand for one day until expiration, two days until expiration, etc. Options that expire in one day, two days, etc.) 0DTE charts are available for Volland 3, Volland 30, and Volland Live. They update on the timeframe of your subscription (i.e., 0DTE charts are updated every 30 minutes in Volland 30). To see a 0DTE chart in Volland, select your ticker, your greek, and today’s expiration only. These are the core principles and assumptions underlying this framework. These principles are realistic and have shown to be true with our own observations and discussions with MMs. Under these principles will be their rationale.

Principle #1: Dealers need to be fully hedged by the end of the day, including in 0DTE. In the old days, dealers had to hedge all their 1st- and 2nd-order greeks within a range and fill out a form of their book to prove it. If they failed one greek once, they were warned. If they failed twice, they were fired, and likely not hired to any other MM firm! Also, note that we do not yet know for sure the dealer’s position in the underlying.

Principle #2: Dealers will trade options to become risk neutral in aggregate vanna and charm. Vanna and charm are two sides of the same coin, that being premium of the option. The option premium is made up of two components: time and IV. Both are difficult to hedge when moving quickly, and both move quickly on 0DTE.

Principle #3: Premium is 0 when options expire. This is the primary difference between 0DTE and higher-order Volland. On a higher order Volland (particularly on the 30-day timeframe), there is a consistent spot-vol correlation that is the basis for skew, vanna moves, etc. 0DTE is simpler because IV and time premium run to 0. So, you know exactly the direction of IV and the impact on underlying hedging requirements.

Principle #4: 0DTE options are cheap greeks. While one 0DTE ATM option has a higher gamma than a 20DTE ATM option, its sphere of influence is much smaller. Therefore, as price moves, the greeks of the 0DTE option mean less. This is important because the initial option positioning will have less of an effect the further price moves away from it.

0 Comments

Leave a Reply. |

The WizardJason DeLorenzo Archives

September 2023

Categories |

|

RSS Feed

RSS Feed